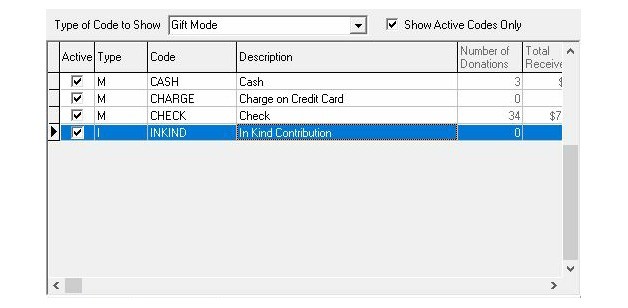

1. Mode Code Denotes In-Kind or Monetary

When entering a gift in FundRaiser, the Mode Code is used to differentiate not only between methods of payment (cash, check, charge, etc.) but also between monetary or in-kind donations. When you create a Mode Code you must specify whether that code will be monetary or in-kind. A Mode Code is always one or the other, and each gift requires a Mode Code. You may have multiple codes, as is usual in FundRaiser, which allows for specific types of in-kind donations. For instance, one of our users is a diaper bank, and, while they accept many infant-related types of in-kind donations, they need to keep diaper donations separated from others. The easiest way was to have, simply, a "diaper" Mode Code. When running various reports, you can specify to include monetary, or in-kind, or both types of donations. Use these codes to your advantage. And check out the Coding & Spare Fields training video in the Customer Portal section of our website.

2. Use the Merge Notes for Descriptions

On each gift record is a "Letter Notes for Merging" section. It is primarily used for notes that will then be merged into thank you letter templates. And for monetary gifts, these are usually personal greetings, of sorts, like "Gee, it was great to see you", or "Glad to see you've recovered from surgery", or something else to more personalize the thank you letter. For In-Kind donations, this is a great place to put a description of the items (or services) that were donated. It makes a permanent record as well as an easy way to pull that description in to a thank you letter. More information on entering gifts is available in both the FundRaiser Overview and Recurring Gifts training videos available in the Customer Portal section of our website.